Property Plant and Equipment Intensity and Its Impact on Profitability. Ghanaian listed firms at a glance

Property plant and equipment represents substantial investments particularly to manufacturing, extractive and telecommunication companies. The method of recognition and measurement for such assets can have significant impact on the profitability of the firm. In this article, I examine the intensity of Property Plant and Equipment, the depreciation methodology and the overall impact on profitability.

As per IAS 16, PPE can be defined as tangible assets that are held for use in the production or supply of goods and services or for rental to others, or for administrative purposes and are expected to be used during more than one accounting period (more than one year). Ex-ante, a company spends an initial investment to purchase this asset with the hope that, these assets will generate, or facilitate in the generation of income (in the economic sense of it). Once recognized in the statement of financial position, an entity needs to provide for depreciation ie. Spread the cost of the asset over its estimated useful life taking into account any residual value. The common methods of charging depreciation are the straight-line method, the diminishing balance method the sum of the year’s digits method and the units of production method. The methods of depreciation accounting differs from firm to firm, but in the long run, irrespective of the accounting method used, the net effect on the financial statement should be the same. However, a problem arises when companies’ profits are compared with each other in the short run given that the amount of depreciation can distort profit levels.

A review of the financial statements of Ghanaian listed firms reveal that a majority prefer the straight-line method of charging depreciation as opposed to the diminishing balance method. The rationale of the straight-line method of depreciation is that, an equal amount of the assets useful life is consumed on an annual basis. This results in a constant depreciation charge for the assets over the assets useful life provided there are no revaluations or major improvements to the asset in the following accounting period. The advantage to this method is that, it is easy to understand and apply in practice hence many professional accountants prefer this method to the diminishing balance method. Another reason for its popularity is that, it is a tool of gauging stable profits over the years as there is no variability in the depreciation expense. The hind side of this method is that, for some assets, businesses turn to use them more when the asset is new than when it gets older. For some industries, the seasonal nature of it may require more usage of the asset when demand peaks. This will mean that, there is an under charge for depreciation in that year when the asset is over used that in period when the asset is idle.

For example suppose company A buys a machine for Gh¢10,000 and the estimated useful life of the asset is 10 years without any residual value. The annual depreciation charge of Gh¢10,00 is charged as an expense to the income statement as see from the table below.

| Straight-line Method Depreciation Charge | |||

| Year | Annual Depreciation Charge | Net Book Value | Accumulated Depreciation |

| 1 | 1,000 | 9000 | 1000 |

| 2 | 1,000 | 8000 | 2000 |

| 3 | 1,000 | 7000 | 3000 |

| 4 | 1,000 | 6000 | 4000 |

| 5 | 1,000 | 5000 | 5000 |

| 6 | 1,000 | 4000 | 6000 |

| 7 | 1,000 | 3000 | 7000 |

| 8 | 1,000 | 2000 | 8000 |

| 9 | 1,000 | 1000 | 9000 |

| 10 | 1,000 | 0 | 10000 |

| Source: Own Calculations | |||

The diminishing balance method on the other hand assumes that in the early life of the asset, a higher depreciation charged is more appropriate than in the later life as most assets turn to be more productive and heavily used when new than when it is old. This involves the application of a constant rate of depreciation to the diminishing value of the asset. Assume the example above holds true, with a depreciation rate of 20%, the same asset could be depreciated as follows;

| Diminishing Balance Depreciation Charge | ||||

| Year | Annual Depreciation Charge | Annual Depreciation Percentage | Net Book Value | Accumulated Depreciation |

| 1 | 2000 | 20% | 8000 | 2000 |

| 2 | 1600 | 20% | 6400 | 3600 |

| 3 | 1280 | 20% | 5120 | 4880 |

| 4 | 1024 | 20% | 4096 | 5904 |

| 5 | 819 | 20% | 3277 | 6723 |

| 6 | 655 | 20% | 2621 | 7379 |

| 7 | 524 | 20% | 2097 | 7903 |

| 8 | 419 | 20% | 1678 | 8322 |

| 9 | 336 | 20% | 1342 | 8658 |

| 10 | 268 | 20% | 1074 | 8926 |

| Source: Own Calculations | ||||

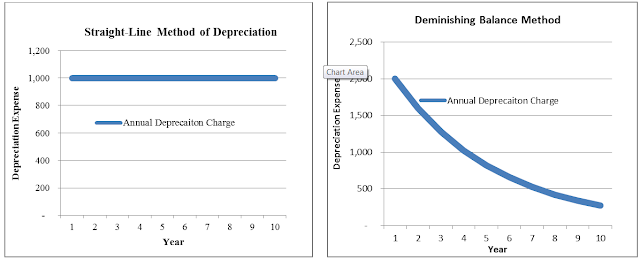

It is clear that the depreciation charge for the first three years using the straight line method is Gh¢ 3000 (1000+1000+1000) less than that of the diminishing balance method of Gh¢ 4880 (2000+1600+1280) for the same period. A visual comparison of the two common approaches to depreciation accounting should help in understanding its impact on financial statements.

Depreciation Expense Impact earnings

A review of the financial statements for a cross – section of Ghanaian listed firms suggests that PPE is concentrated around the manufacturing industry. Evidence also point to the fact that for most companies, the Straight-line method of depreciation is a better approach as opposed to the diminishing balance method.

| Depreciation Policy of Major Ghanaian Listed Companies | |

| Company Name | Depreciation Policy |

| Alluworks Ltd | Straight-Line |

| Benso Oil Palm Plantation | Straight-Line |

| Accra Brewery | Straight-Line |

| Mechanical Llyods | Deminishing Balance |

| Camelot Ghana Ltd | Straight-Line |

| Guinness Ghana Ltd | Straight-Line |

| Starwin Products | Straight-Line |

| Fan Milk Ghana | Straight-Line |

| Unliver Ghana | Straight-Line |

| Total Petroleum | Straight-Line |

| Produce Buying Company | Deminishing Balance |

| Ghana Oil Company | Straight-Line |

| Enterprise Group | Straight-Line |

| SIC Insurance | Straight-Line |

| Trust Bank Ghana | Straight-Line |

| SG-SSB | Straight-Line |

| UT Financial Services | Straight-Line |

| HFC Bank | Straight-Line |

| Cal Bank Ltd | Straight-Line |

| Eco Bank Ghana | Straight-Line |

| Ghana Commercial Bank | Straight-Line |

| Standard Chartered Bank | Straight-Line |

| Source: Notes to Financial Statements | |

In practice, the depreciation method chosen could have material impact on the financial statements particularly when comparing company profitability metrics. The reason for this may be apparent, but for the sake of clarity, let me provide some insights. For companies using the straight-line method, depreciation expenses are more predictable and there is a stable deprecation charge over time. However, for the diminishing balance method, depreciation charge is higher in the initial years for the asset. This means that depreciation charge for comparable companies will be different for a given financial period. On the face value of it, the earnings of companies using the straight line method will be higher in the initial years than companies using the declining balance approach.

| Materiality of and Property Plant and Equipment and its depreciation (FY 2010) | |||||||

| EBIT (a) | EBITDA(b) | Depreciation and Amortization (a-b) | PPE | Total Assets | Deprecation As Percentage of PPE | PPE as Percentage of Total Assets | |

| SG-SSB LTD. | 37019 | 39973 | 2954 | 25418 | 685913 | 12% | 4% |

| Trust Bank (The Gambia) | 104891 | 150684 | 45793 | 256853 | 3415510 | 18% | 8% |

| Standard Chartered Bank | 162706 | 164732 | 2026 | 19414 | 1667882 | 10% | 1% |

| Accra Breweries | 403 | 3765 | 3362 | 45130 | 74129 | 7% | 61% |

| Guinness Ghana | 21986 | 38611 | 16625 | 143643 | 197081 | 12% | 73% |

| Starwin Products | 570 | 764 | 194 | 1555 | 3792 | 12% | 41% |

| UT Financial Services | 52589 | 55352 | 2763 | 20907 | 516632 | 13% | 4% |

| Fan Milk Ghana | 25969 | 30841 | 4872 | 29530 | 68391 | 16% | 43% |

| African Champions | 86 | 270 | 184 | 6923 | 9084 | 3% | 76% |

| Alluworks | -5629 | -2678 | 2951 | 41851 | 55638 | 7% | 75% |

| Ghana Oil Ltd | 11173 | 13551 | 2378 | 26057 | 103539 | 9% | 25% |

| GoldenWeb. | -391 | -180 | 211 | 1438 | 2610 | 15% | 55% |

| Total Petroleum | 27620 | 32983 | 5363 | 57287 | 176194 | 9% | 33% |

| Ayrton Drug | 3112 | 3527 | 415 | 4395 | 16795 | 9% | 26% |

| Camelot Ghana | 405 | 645 | 240 | 1836 | 3101 | 13% | 59% |

| Source: Thomson Reuters Datastream, Own calculations | |||||||

The depreciation rate of assets for some firms differ materially from others as different depreciation methods are applied with different depreciation rates. However, I should mention that, as per IAS 16 accounting for Property Plant and Equipment, once a particular depreciation method is chosen, it should be applied consistently year –on-year. Merely comparing one year earnings results of two or more companies without taking into account depreciation charge could obscure visibility on the drivers of earnings. Users of financial statements should be aware that, a choice of accounting policy for PPE, ie the cost model or the revaluation method to a large extent determines the depreciation charge on an annual basis.

most affordable biology environmental such as plant press providers in india.read more

ReplyDeleteIt has helped me, Thank you for sharing this information.

ReplyDeleteAluminium Scaffolding Rental